Facts about the replacement levy

Is this a new tax?

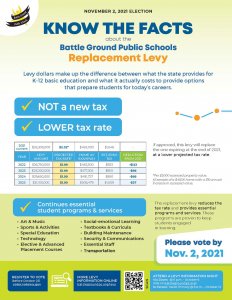

This is not a new tax. It will replace the levy that expires at the end of 2021 at a lower rate and will allow current essential programs and services to continue. Levies do not pay for new school construction.

What will this levy cost?

If approved by voters, the four-year levy will raise $26.8 million in 2022, $28.2 million in 2023, $29.7 million in 2024, and $31.1 million in 2025. The district can never collect more than these amounts, even if the district’s assessed value increases. The tax rate for the levy is projected to be $1.99 for all four years, which is less than the 2021 rate of $2.32, which has total collections of $28.3 million.

A property assessed at $450,000, for example, would pay $923 in taxes for this levy in 2022. The actual impact on property owners will depend on the increase or decrease in assessed value, as well as the amount of growth in the district from new homes.

Why do we have levies?

The state does not fully fund the programs that are an essential part of student success in today’s world. In 2018, the state changed the way it funds public education by lowering local school taxes, NOT eliminating local school levies. The state authorizes school districts to levy up to $2.50 per $1,000 of assessed value for local control of student programs.

What if the levy doesn't pass?

The levy provides 14% of the district’s budget. An annual loss of $28 million in local funding would require the district to make cuts to student programs and services that could result in:

- Larger class sizes—staff reductions & furloughs

- Increased time on buses & fewer routes

- Loss of music, art, theater & academic extracurricular funding

- Outdated textbooks & instructional materials

- Limited technology

- Fewer support staff—less assistance for technology, recess, school offices, custodial, grounds & more

- Elimination of programs & fewer class choices

- Fewer activities & sports with higher fees

- Reduction in social-emotional supports

- Reduced supply & building budgets

- Deferred building maintenance

- Cuts from general education to reallocate funds for state-mandated

programs such as special education.

After a double levy failure in the 1980s, the district had to eliminate middle school sports and give up its buses.

Didn't the state fully fund education?

School funding is a work in progress. In 2018, after the McCleary decision, state legislators changed property taxes with the intent of fully funding basic education and lowering local school taxes, NOT eliminating local school levies. The state increased what it collects in property taxes for basic education statewide, and capped what school districts can collect locally. As a result, Battle Ground’s levy rate decreased from $3.45 in 2018 to $2.50 in 2020.

Why is state funding inadequate?

There are several areas of education that the state does not fully fund as part of basic education. Examples include technology, special education services, social-emotional learning, building maintenance, elective classes, and Advanced Placement programs, and athletics and student activities. Districts are left to figure out how to pay for these services and programs on their own.

Additionally, the state does not fund all the staff necessary to provide essential services and programs to students. The state’s funding formula for K–12 education, called the Prototypical School Funding Model, sets student-to-staff ratios based on a study completed in 1975. Education is vastly different 45 years later, but the Prototypical School Funding Model has not been updated to account for modern educational needs.

What is the difference between a levy and a bond?

In general, levies provide for learning, maintenance, and operations and bonds go to construct buildings. Battle Ground voters last approved a bond in 2005 to finance the construction of several new schools, additions, and improvements. That bond will be paid in full in December 2023, so it will drop off property tax bills in 2024.

406 NW 5th Ave.

406 NW 5th Ave.